Investment/acquisition/partnership support

With the need to create innovation in a shorter period of time, more companies are using methods such as investment and acquisition. Individual in CovalentWe support the search, execution and promotion of investment and acquisition projects. at the same time,We also provide support to incorporate these methods into the system as part of innovation creation.

If you want to understand the details of the service such as the output image, please request detailed materials from the following.

ISSUES

Issue

-

I would like to promote venture investment or M&A, but I am in trouble because I have no experience from sourcing/DD to investment/acquisition execution.

-

We lack internal resources or knowledge and would like to ask external parties to promote some operations (e.g. due diligence)

-

In particular, there are high hurdles in discussing alliances/investments and acquisitions with overseas companies, and I do not know how to proceed.

Concerns when considering individual investments and acquisitions

SERVICE MENU

service menu

Individual deal promotion support

We identify companies to acquire or invest in that meet your objectives. We conduct due diligence on the target company from various angles and evaluate it to support your acquisition/investment. Furthermore, we will work with you to promote PMI for synergy creation after acquisition/investment.

APPROACH

approach

Individual deal promotion support

1

Discovery and organization of targets

We understand the client's future vision and awareness of issues, and organize the purpose of acquisition or investment activities and the requirements of the target company.

We will list and contact target companies that fit the listed requirements, and source candidates that can be evaluated and negotiated.

Minimum 1 month

2

Acquisition/investment selection/DD support

In particular, we will select target companies from the perspective of technology and innovation contribution. In addition, we provide evaluation support centered on business due diligence.

Minimum 2 months

3

Negotiation and closing support

We assist clients in negotiating key contractual clauses (especially valuation and investor protection clauses) and in preparation of the client's internal approval process.

Minimum 2 months

Four

PMI support

An integration plan and a promotion system are essential for generating synergies over the medium to long term. Focusing on planning, organization, and operations, we support everything from formulation to execution of integration, including systems as necessary.

~Several months

ADVANTAGE

advantage

Through collaboration with VCs in each region, we are reaching out to startup ecosystems such as China and India, which are particularly large markets. We can also provide information on technology and startup trends in regions where it is difficult to obtain information in Japan.

We can source information from our experience and our own network.

There are various cultural differences when acquiring or investing in a foreign company. We have members with overseas work experience and overseas acquisition/investment experience, and after guessing the reaction expected at the time of negotiations and the intention of the other party's proposal from various angles, We can propose communication strategies to advance negotiations favorably without compromising We can also support smooth business communication with European, American and Chinese companies.

We can propose appropriate communication strategies that understand the overseas corporate culture.

We have a wealth of knowledge about FA/DD/investment practices, mainly from members who have experience working at foreign FA firms and overseas venture capital firms. We can advise you on the series of flows in corporate alliances, M&A, and startup investment, as well as points at issue, preparations, and points to watch out for at each step. We can also support DD, which is particularly burdensome, in cooperation with external experts.

We have abundant practical knowledge of FA/DD/investment in overseas companies.

Output

OUTPUT

Target company list

We will list companies that meet your needs and requirements. In addition, this list is also used as a contact progress management table.

DD report

We will prepare a report of due diligence conducted by our company, discuss and report. We will evaluate the business feasibility centered on technical DD and business DD.

PMI Plan

We will create a plan such as a 100-day plan according to your request. Of course, we will formulate business development strategies, including restructuring of the organizational structure and integration of business processes.

TRACK RECORD

achievement

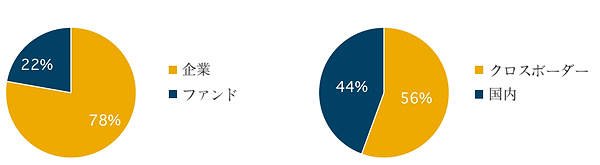

Examples of M&A/investment projects

Project type

CLIENTS' VOICE

customer's voice

Global IT Service Provider

Great insight on Japan market and auto sector

Covalent managed our acquisition activites from sourcing target company to various negotiation excutions. It was a long run, and we couldn't achieve the result without Covalent's great support.

Major construction company

Excellent network of overseas venture companies

Regarding specific advanced technology, we have been able to gather information on related venture companies. After listing many venture companies from South America to Europe and conducting DD, they also supported investment negotiations and closing.